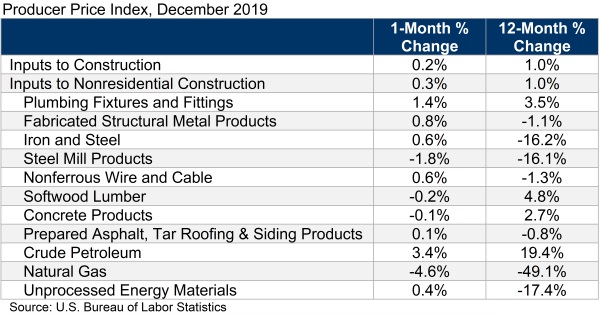

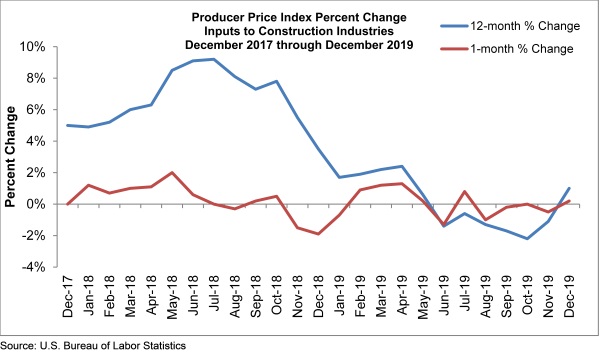

Construction input prices rose 0.2% in December 2019 and are up 1.0% year over year, according to an Associated Builders and Contractors analysis of the U.S. Bureau of Labor Statistics’ Producer Price Index data released today. Nonresidential construction input prices rose 0.3% for the month and are also up 1.0% since December 2018.

Natural gas (-49.1%) again experienced the largest year-over-year price decrease and was down nearly 5% on a monthly basis. Unprocessed energy materials prices were down 17.4% compared to the same time in 2018 but up 0.4% compared to November 2019. Two other subcategories experienced year-over-year price decreases greater than 10%: iron and steel (-16.2%) and steel mill products (-16.1%). Among the 11 subcategories considered in this release, seven experienced year-over-year price decreases.

“With the global economy firming and demand for materials in the United States still elevated, contractors should expect gradual increases in materials prices going forward,” said ABC Chief Economist Anirban Basu. “ABC’s Contractor Backlog Indicator, which has hovered around nine months since August 2019, and Construction Confidence Index, which reported contractors remained confident about near-term prospects for sales and profit margins, both suggest that domestic demand will remain lofty through the first half of 2020.

“While input costs appear to be stabilizing after declining for much of the past two years, contractors face little risk of a spike in prices,” said Basu. “This is especially true with respect to energy prices, which continue to remain stable even in the context of geopolitical turbulence. U.S. energy production continues to trend higher, helping to support historically low prices, especially for natural gas.

“Recent trade deals should also help moderate future materials price increases,” said Basu. “The first phase trade deal with China and progress on the new United States-Mexico-Canada Agreement, which replaced NAFTA, should help keep commodities moving across borders, moderating price pressures in the process.”